1 oz gold bar ($5,000 a/o February 2026) - Collectible 1882 Morgan silver dollar ($87).

Go to Precious Metals for information about silver.

See history below:

Gold has some intrinsic value because of scarcity, and is used by investors as a hedge against uncertainty in stocks and bonds which are influenced by macroeconomic and geopolitical conditions, which are in flux right now. As demand for gold goes up the price will rise.

Below are some places with information on the value of gold..

Note:

Central banks and foreign investors held over $8.5 trillion in US: Treasury securities primarily because they are viewed as the world's safest, most liquid, and reliable store of value.

In 1985, Central banks, especially in emerging markets like China, India, Russia, and BRICS nations, are actively diversifying their foreign reserves away from U.S.

| Institution | 2026 Year-End Target (per oz) | Key Driver |

|---|---|---|

| Goldman Sachs | $5,400 | Private-sector diversification & AI investment risksJ. |

| P. Morgan | $5,055 | Continued stagflation risks & central bank stacking |

| Bank of America | $6,000 | U.S. debt concerns & "anti-Trump trade" sentiment |

| GlobalData | $6,100 – $6,700 | Trade tariffs and currency volatility In that case prices could rise at the same rate they were over the last 2 years. |

| Price year End | % gain | |

|---|---|---|

| 2022 | $1,864 | |

| 2023 | $2,060 | 11% |

| 2024 | $2,624 | 27% |

| 2025 | $5,000 | 91% |

| Projected | ||

| 2026 | $6,500 | 30% |

| 2027 | $8,600 | 30% |

Central bank demand for gold is primarily driven by the following factors:

1. Reserve Diversification and De-Dollarization Central banks, especially in emerging markets like China, India, Russia, and BRICS nations, are actively diversifying their foreign reserves away from U.S. dollar-denominated assets. Gold provides a sanction-proof, politically neutral store of value, reducing reliance on the U.S. financial system and mitigating risks associated with geopolitical tensions or asset seizures—highlighted by the freezing of Russian reserves after 2022.

2. Hedging Against Inflation and Currency Devaluation

Gold acts as a natural hedge against inflation and currency depreciation. Unlike fiat currencies, gold has a finite supply and carries no credit or counterparty risk, making it a trusted asset during periods of monetary expansion or fiscal instability.

3. Geopolitical and Economic Uncertainty Rising global tensions, trade conflicts, and financial volatility increase gold’s appeal as a safe-haven asset.

Central banks use gold to protect national wealth during crises, ensuring balance sheet resilience amid unpredictable global events.

4. Institutional Trust and Financial Stability

Gold enhances confidence in a nation’s financial system. Its inclusion in reserves signals stability, supports monetary credibility, and strengthens trust—especially in countries facing external shocks or capital outflows.

5. Structural Market Support

Central bank purchases create a structural price floor for gold. Their long-term, steady buying—projected at 190 tonnes quarterly in 2026—reduces market volatility and supports sustained price appreciation, independent of short-term investor sentiment.

What some are saying as of Jan 23, 2026:

Gold prices are projected to continue their upward trajectory in the near future, with multiple analysts forecasting significant gains by the end of 2026 and beyond.

The price of gold is influenced by macroeconomic and geopolitical conditions, the pace of inflation, the amount of reserves, currency fluctuations, supply and demand considerations, and the cost of mining and refining the precious metal.

When inflation is high, the price of gold tends to rise as investors look for a safe-haven asset to protect their purchasing power and as an inflation hedge against the weakening buying power of national currencies like the dollar.

When geopolitical tensions are high, gold prices tend to rise as investors seek a hedge against uncertainty. Gold is used to ride out macroeconomic volatility. Still, these correlations don’t always hold, and the price won’t always rise in the face of inflation or broader economic uncertainty.

In addition, as can be seen from the first half of the 2020s, gold and stocks aren't inversely correlated; both have risen significantly simultaneously.

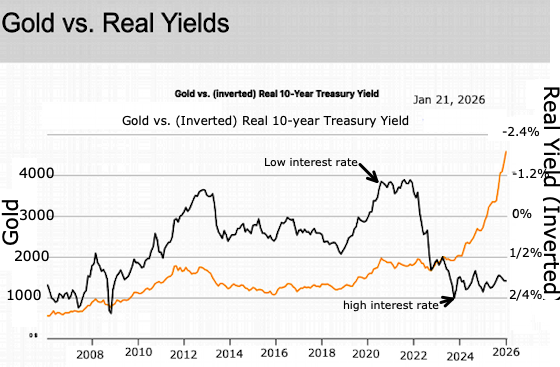

Long Term Trends - Gold vs. Real Yelds

The real interest rate is defined as the difference between the nominal interest rate and the (expected or actual) inflation rate.

Rising interest rates also mean rising opportunity costs of holding gold. Gold neither pays dividends nor interest. Thus, it is relatively expensive to hold it in the portfolio when real interest rates are high. On the other hand, when real yields are negative, holders of cash and bonds are losing wealth. In such a scenario, they are more prone to buy gold.

Gold prices: beyond inflation and real yields